How To Find Total Manufacturing Overhead Cost

Manufacturing Overhead Formula (Table of Contents)

- Formula

- Examples

- Figurer

What is the Manufacturing Overhead Formula?

The term "manufacturing overhead" refers to all the indirect costs that are incurred during the process of product but not directly assignable. However, in lodge to recognize inventory and cost of goods sold (a.one thousand.a. cost of sales) according to generally accepted bookkeeping principles (GAAP), it is essential to capture manufacturing overhead along with the direct costs such as cost of raw material and direct labor which then can exist assigned to each unit produced. Examples of manufacturing overhead include depreciation on constitute and mechanism, rent for the product facility, salaries of product managers, utilities, etc. The formula for manufacturing overhead can exist derived by deducting the cost of raw material and direct labour price (a.k.a. wages) from the cost of goods sold. Mathematically, it is represented equally,

Manufacturing Overhead = Cost of Appurtenances Sold – Cost of Raw Material – Direct Labour Cost

Examples of Manufacturing Overhead Formula (With Excel Template)

Allow'southward take an case to understand the calculation of Manufacturing Overhead in a better way.

Yous tin download this Manufacturing Overhead Formula Excel Template here – Manufacturing Overhead Formula Excel Template

Manufacturing Overhead Formula – Example #1

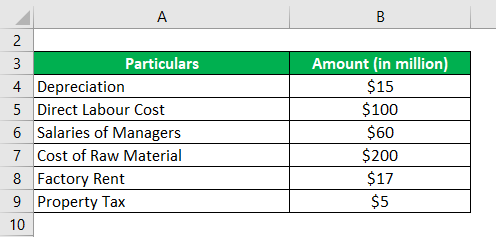

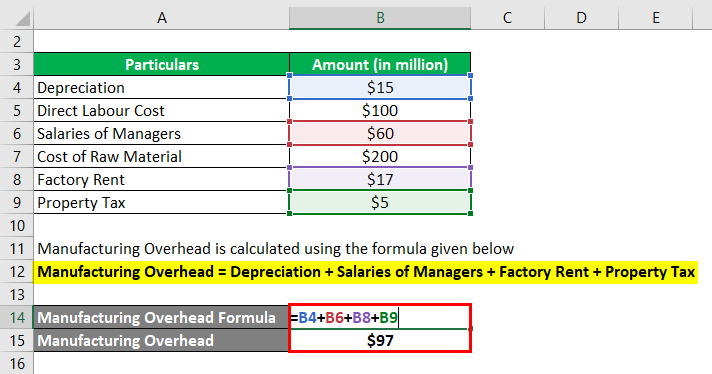

Permit united states take the example of a company and look at its various cost fields and and then calculate the manufacturing overhead.

Solution:

From the above list, depreciation, salaries of managers, factory hire and holding tax fall in the category of manufacturing overhead. Direct labour cost and cost of raw material are straight costs of product. Therefore, the

Manufacturing Overhead is calculated using the formula given beneath

Manufacturing Overhead = Depreciation + Salaries of Managers + Factory Rent + Property Tax

- Manufacturing Overhead = $15 million + $60 million + $17 million + $5 million

- Manufacturing Overhead = $97 1000000

Therefore, the manufacturing overhead of the company for the year stood at $97 one thousand thousand.

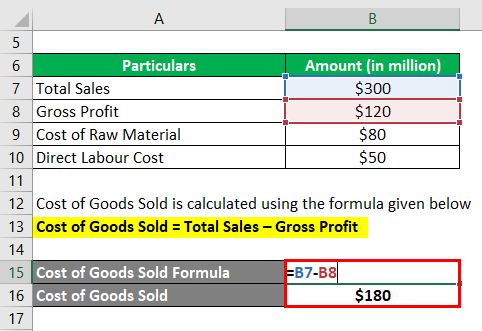

Manufacturing Overhead Formula – Example #two

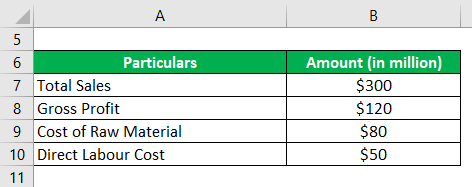

Let u.s.a. take the example of a company ASF Ltd which is engaged in the manufacturing of leather bags. During 2018, the company reported a gross profit of $120 million on a full sales of $300 million. If the cost of raw material and directly labour cost are $fourscore one thousand thousand and $fifty one thousand thousand respectively, then calculate the manufacturing overhead of ASF Ltd for the year.

Solution:

Cost of Goods Sold is calculated using the formula given below

Cost of Goods Sold = Total Sales – Gross Turn a profit

- Price of Appurtenances Sold = $300 meg – $120 1000000

- Cost of Goods Sold = $180 million

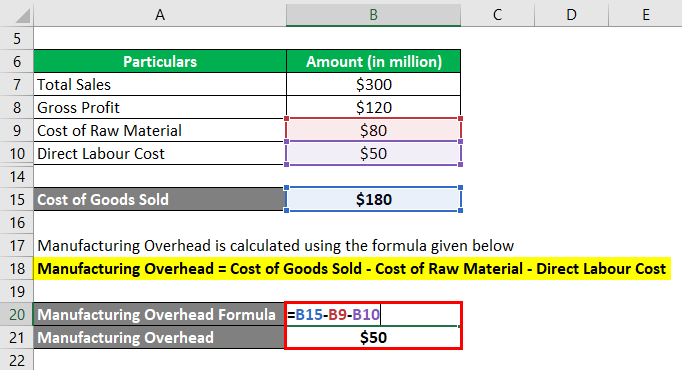

Manufacturing Overhead is calculated using the formula given beneath

Manufacturing Overhead = Cost of Goods Sold – Cost of Raw Material – Straight Labour Cost

- Manufacturing Overhead = $180 1000000 – $lxxx 1000000 – $50 million

- Manufacturing Overhead = $50 million

Therefore, the manufacturing overhead of ASF Ltd for the year stood at $l 1000000.

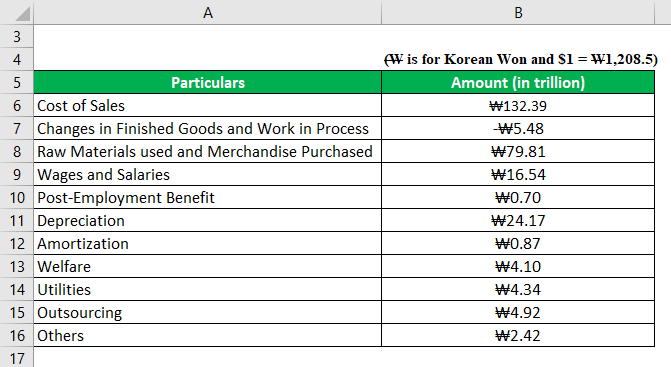

Manufacturing Overhead Formula – Example #3

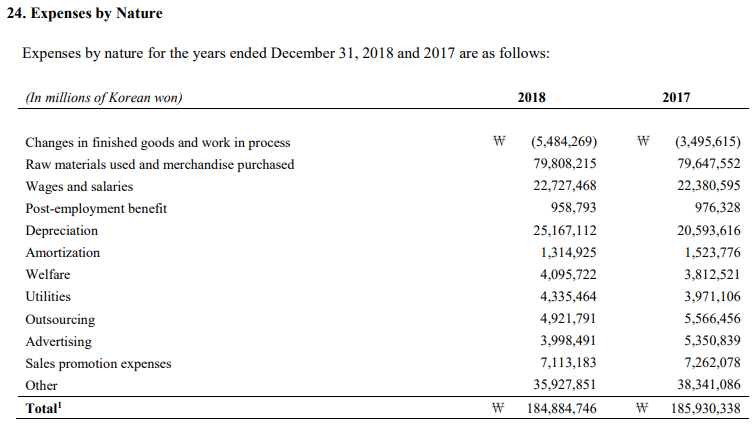

Permit usa take the example of Samsung's almanac report for the yr 2018. During 2018, the company incurred the cost of sales of W132.39 trillion. The post-obit break-upwards of the cost of sales is provided. Based on the given information, summate the manufacturing overhead of Samsung for the year 2018.

Solution:

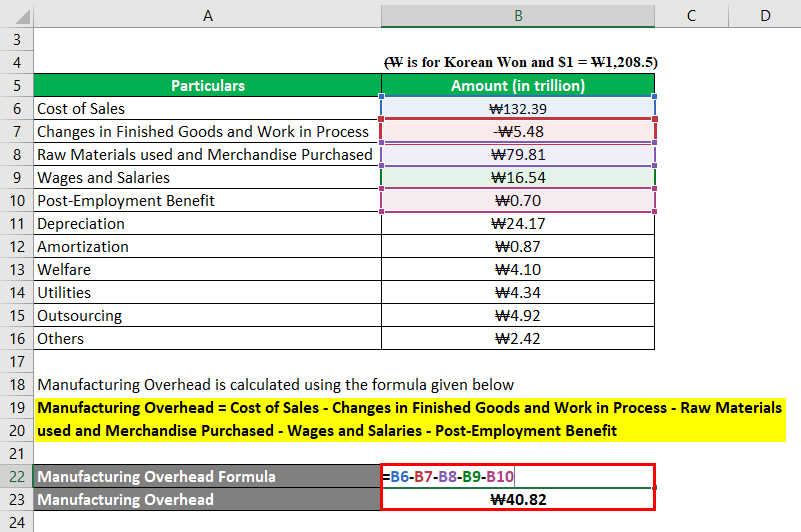

In the in a higher place break-up, changes in finished goods and work in process, raw materials used and trade purchased, wages and salaries and post-employment benefit can be identified as straight costs of product. Therefore,

Manufacturing Overhead is calculated using the formula given beneath

Manufacturing Overhead = Cost of Sales – Changes in Finished Appurtenances and Piece of work in Process – Raw Materials used and Trade Purchased – Wages and Salaries – Postal service-Employment Benefit

- Manufacturing Overhead = W132.39 – (- W5.48) – W79.81 – W16.54 – W0.70

- Manufacturing Overhead = W40.82 trillion

Therefore, the manufacturing overhead of Samsung for the year 2018 stood at W40.82 trillion.

Source: SAMSUNG

Explanation

The formula for manufacturing overhead can exist derived by using the following steps:

- Step 1: Firstly, decide the cost of goods sold which includes all directly and indirect costs of production. It is hands bachelor as a separate line particular in most of the income statements.

- Pace ii: Side by side, determine the cost of raw material which includes the price of raw material buy during the yr adjusted with the alter in inventory. It is also either available in the summary of the income argument or in its scheduled notes.

- Step three: Next, determine the cost of direct labour which includes the expenses associated with the product labours that are directly engaged in the product process.

- Step 4: Finally, the formula for manufacturing overhead tin can be derived by deducting the cost of raw cloth (pace 2) and direct labour cost (step iii) from the price of goods sold (step 1) as shown beneath.

Manufacturing Overhead = Cost of Goods Sold – Toll of Raw Material – Direct Labour Cost

Relevance and Uses of Manufacturing Overhead Formula

Both Generally Accepted Accounting Principles (GAAP) and International Fiscal Reporting Standards (IFRS) mandates resource allotment of manufacturing overhead to the production cost, such that it is captured in the price of goods sold (income statement) and the inventory belongings (balance sheet). Such a requirement by the ii major governing bodies makes it quintessential to understand the concept of manufacturing overhead.

Manufacturing Overhead Formula Calculator

You tin apply the following Manufacturing Overhead Formula Computer

| Cost of Goods Sold | |

| Cost of Raw Material | |

| Direct Labour Toll | |

| Manufacturing Overhead | |

| Manufacturing Overhead = | Toll of Goods Sold - Cost of Raw Textile - Direct Labour Cost | |

| 0 - 0 - 0 = | 0 |

Recommended Articles

This is a guide to Manufacturing Overhead Formula. Here we discussed how to calculate Manufacturing Overhead Formula forth with practical examples. We likewise provide a Manufacturing Overhead reckoner with a downloadable excel template. You may also look at the following articles to larn more –

- Formula For Central Tendency

- How to Summate Portfolio Return?

- Examples of Interest Expense

- Calculation of Net Interest Margin

Source: https://www.educba.com/manufacturing-overhead-formula/

Posted by: slaytonopeashom.blogspot.com

0 Response to "How To Find Total Manufacturing Overhead Cost"

Post a Comment